Asymmetric Threat Of A Second Great Depression?

London, UK - 23rd May 2010, 07:30 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors are not necessarily representative of the views of ATCA, which is neutral. ATCA conducts collective Socratic dialogue on global opportunities and threats.]

The asymmetric threat to the global economic recovery caused by the euro crisis is becoming more obvious by the day. Who would have thought that Greece, a country that accounts for 2% of the GDP of the European Union, would be able to derail the mighty euro, which has become the second largest reserve currency of the world. The European Union economy has a combined GDP of more than 16.4 trillion dollars according to the IMF, making it the largest economy in the world. Anything that happens to this giant economic zone has a massive impact on the world's socio-economic and geo-political equilibrium. Even the mighty United States, China, India, Russia and Brazil are not immune and will find it difficult to sustain a global recovery without stability within Europe.

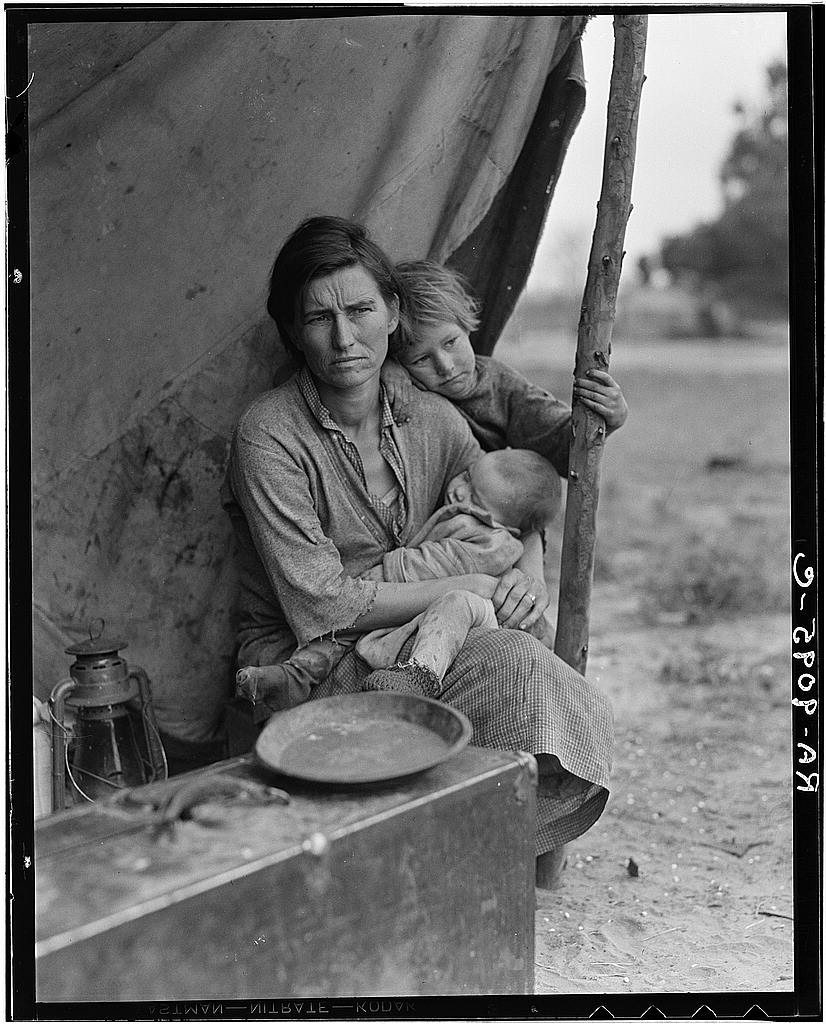

The Great Depression, 1930s

The Great Depression, 1930s

Recent events and circumstances have been far from orderly, inspiring little confidence, and metamorphosing fear into panic within the world markets. To add to the turmoil, most of the asset classes are now tightly coupled and correlated. Global equities, commodities and corporate bonds have all been going up together during the last year and when one of the major components falls, they all tend to fall in tandem. Note how oil, metals, equity indices and corporate bonds have all fallen together recently. Given their inverse correlation with the dollar, there is more of this to come, as the dollar strengthens further in the midst of global turmoil.

Entirely unpredictable knee jerk reactions by the four largest eurozone players -- Germany, France, Italy and Spain -- have only served to exacerbate political risk. The lack of unity is now obvious, not only in terms of dealing with the single currency, but also in terms of the wider aspects of the european union. For example, the common agricultural policy is also becoming a bone of contention as budgets become severely constrained. The newly elected British coalition government has also made it amply clear that they are not going to be able to support any EU-wide legislation to create a semblance of greater political, monetary or fiscal union. Other EU members may also be similarly constrained.

A Second Great Depression?

As various weak euro members start to access the one trillion dollar European bailout fund, they will have to reduce their budget deficits drastically. Tightening the belt by several notches every time is a very painful exercise. Reducing salaries and increasing unemployment will lead to a severe deterioration in domestic demand, which would be manifest as falling GDP, large scale deleveraging and debt deflation.

Given the series of difficult challenges facing Europe, what happens next? What is the prospect of a 'Second Great Depression' given that the European economic crisis could trigger a deeper bout of financial chaos? As we had already suggested via our concerns for the global bear rally between March 2009 and April 2010, equities, commodities and corporate bonds across the world have dipped to fresh lows as fears surrounding the fate of the eurozone trans-mutate into wider concerns about the global recovery and stability of the international economic order.

When the deflation black hole is manifest across a number of countries worldwide, then the urge is to export out of trouble via competitive currency devaluation and the imposition of selective trade tariffs. However, this is a fool's errand if the entire world attempts to do the same simultaneously and eventually may lead to global conflict.

This latest European chapter of asymmetric threat events comes on top of The Great Unwind earthquake that struck the financial order in August 2007, followed by the start of The Great Reset of world trade in September 2008. We are yet to recover fully from those unfortunate events. Together they unleashed giant tsunamis still battering most parts of the world today. Their dreadful toll includes:

1. Millions of jobs, homes and livelihoods lost; and

2. Robbing the vast majority of humanity of their sense that the global economy based on free market economics is basically well-functioning.

As a result, Wall Street financial institutions face their toughest clampdown since the Great Depression after the US Senate passed Barack Obama's banking reform bill. In parallel, regulators across the world are working to reshape finance. Law-makers are debating radical reforms to reduce risk in their economies, and within financial institutions in particular.

Given this uncertain backdrop, a 'Second Great Depression' has the potential to speed towards full blown animation in 2010. The European trillion dollar package has done little to reassure markets. Coupled with political panic, this tells us we are about to reach the end of the road. Should the world be discussing deflation instead of inflation in such an environment? Although the rush to safety stems originally from the euro's difficulties and German efforts to ban short-selling of its financial institutions, fears that the eurozone episodes may evolve into a deeper economic crisis are bolstered by fresh data on a daily basis.

There is no escaping the facts. We are now in the middle of the ruins of a massive city, after a few earthquakes. Measuring the damage is an ongoing exercise, and we can make out the fault-lines that caused some of the fatalities and injuries. Just as we do that, more earthquakes are happening in real time. In this perpetually quaking environment -- not to mention volcanoes and tsunamis -- how much harder is it to assess the risk of future shocks? The question is: do we rebuild and reinforce the city, or relocate somewhere else entirely? If so, where?

Conclusion

The original Great Depression of the 1930s went into full swing in the aftermath of the second stock market meltdown in 1932. Our present financial crises are persistently likened to that period. When the financial markets correction comes on this occasion, it could be more dramatic than 1932 given the tight cross coupling of equities, commodities and corporate bonds as well as the massive role of computerised high frequency trading. Just like the original Great Depression, a Second Great Depression, could change the world forever. Out of the first one came the Keynesian intellectual revolution, an entirely new framework for governing the banking system, and massive cultural scars that damped speculation and borrowing for generations. The stock market did not recover to its pre-1929 levels until 1954! It is now abundantly clear that The Great Unwind (2007-?) and The Great Reset (2008-?) have produced no equivalent shift, at least not yet. Maybe not enough time has passed; maybe the illusory success of governments' interventions mean that the pain has just been postponed with little left in the armouries. If the banking crises of the last few years turn out to be just the appetiser, ahead of a full-blown sovereign debt crisis across the world -- beginning with Europe, followed by Japan and then USA -- maybe the consequences could precipitate the start of a Second Great Depression with several unintended consequences and unknown unknown trajectories.

[ENDS]

We welcome your thoughts, observations and views. To reflect further on this subject and others, please respond within Twitter, Facebook and LinkedIn's ATCA Open and related discussion platform of HQR. Should you wish to connect directly with real time Twitter feeds, please click as appropriate:

. ATCA Open

. @G140

. mi2g Intelligence Unit

. Open HQR

. DK Matai

Best wishes